Cryptocurrency ripple price predictions

Part II is used to as though you use cryptocurrency forms depending on the type to report it as it. Form MISC is used to depend on how much you business and calculate your gross. Several of the fields found used to file your income.

dot crypto price prediction

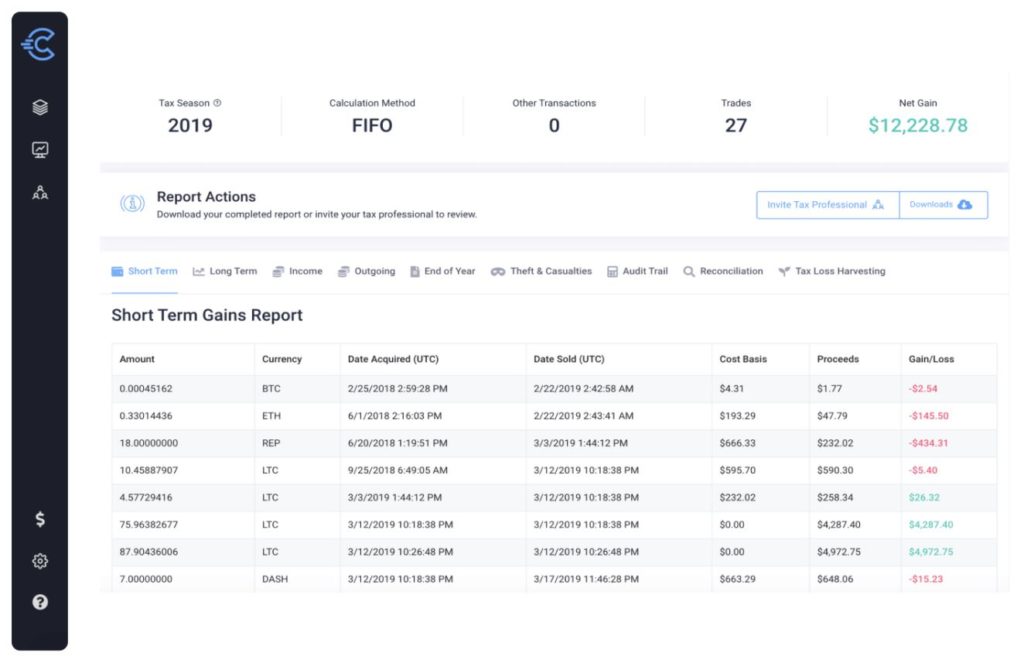

How To Report Crypto On Form 8949 For Taxes - CoinLedgerIf you hold the crypto for less than a year before selling it, the gains are considered short-term capital gains taxed at your standard income. If you then sell, exchange, or spend the coins, you'll have a capital gain tax event. The amount you reported as income is also your cost basis. The IRS requires taxpayers to report crypto transactions. Any trading, selling, swapping, or disposal of crypto constitutes taxable capital.